近日手机摄像头国产芯片CIS(图像传感器)龙头企业韦尔股份(603501.SH),发布了今年上半年度业绩预告,内容显示今年上半年实现营业收入119.04亿元至121.84亿元,同比增长34.38%-37.54%;归母净利润13.08亿元至14.08亿元,同比增长754.11%-819.42%;扣非净利润预计13.18亿元至14.18亿元,上年同期亏损7896.13万元。在公司营收预计增长约三成的情况下,净利润预增超七倍,扣非净利润扭亏为盈。

韦尔股份表示,2024 年上半年市场需求持续复苏,下游客户需求有所增长,伴随着公司在 高端智能手机市场的产品导入及汽车市场自动驾驶应用的持续渗透,公司的营业 收入实现了明显增长;此外,为更好地应对产业波动的影响,公司积极推进产品 结构优化及供应链结构优化,公司的产品毛利率逐步恢复,整体业绩显著提升。

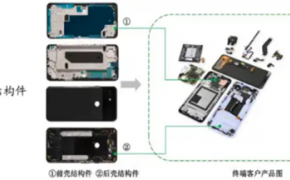

从市场上来看,去年大火的华为P70标准版搭载了韦尔股份旗下豪威科技的OV50H主摄传感器,为韦尔股份今年在中国国产品牌手机推广50MP像素CIS高端定位产品带来了积极的示范效应,多家国产手机厂商从去年下半年开始采用豪威科技的5000万像素高端CIS产品,在拉高豪威科技的产品平均单价与获利能力的同时,也拉动了其它同类产品的销售。

而国内电动汽车的出货量增长,则让豪威科技的车载继续畅销,而国内国产品牌医疗器械行业的持续火热,也让豪威科技的医疗CIS产品营业状况有所改善。

从市场上来看,去年CIS产品大火的华为P70标准版搭载了韦尔股份旗下豪威科技的OV50H主摄传感器,为韦尔股份今年在中国国产品牌手机推广50MP像素CIS高端定位产品带来了积极的示范效应,多家国产手机厂商从去年下半年开始采用豪威科技的50MP像素高端CIS产品,在拉高豪威科技的产品平均单价与获利能力的同时,也拉动了其它同类产品的销售。

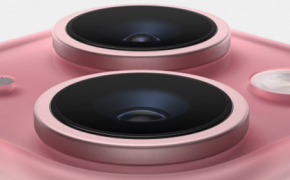

在最赚钱的50MP手机CIS芯片领域,韦尔股份布局了OV50A/D/E/H/K40共五款产品,成功卡位国产高阶智能手机。其中OV50H/K40主打旗舰机主摄市场,特别是V50H凭借超高速对焦能力、高动态范围成功斩获小米、华为、Vivo、荣耀等国内终端旗舰机型份额,应用在这些高端旗舰智能手机的宽幅和超宽幅后置摄像头上;OV50K40是全球首款采用TheiaCel技术的智能手机CIS芯片,凭借LOFIC功能可实现单次曝光接近人眼级别的动态范围;OV50A/E则主打中端机型主摄市场;而像素尺寸仅0.61μm的OV50D可满足长焦等应用。

行业消息显示,华为今年研发的机型,大部分型号的主摄都选择了韦尔股份的CIS芯片,其中50MP CIS芯片仍是重点采购对象。而在华为的示范下,下半年韦尔股份的50MP CIS芯片出货量仍值得行业期待。

业界表示,上半年随着消费电子行业有所回暖,智能手机的销量也恢复增长,再加上电动汽车的摄像头芯片需求持续扩大,CIS芯片行业开始走出清库存阶段,进入正常拉货水平。而晶圆厂也在国内供给大量放出的同时,行业报价也开始改善,慢慢走出成本与售价倒挂的局面。

不过行业人士也表示,随着国内CIS芯片产能的不断释放,低端的手机CIS芯片和车载CIS芯片价格起色并不明显,而且在下半年可能迎来更激烈的价格竞争。

Recently, Weir Co., Ltd. (603501.SH), a leading CIS (image sensor) leading enterprise in domestic chips for mobile phone cameras, released a performance forecast for the first half of this year, showing that in the first half of this year, the operating income was 11.904 billion yuan to 12.184 billion yuan, a year-on-year increase of 34.38%-37.54%; the net profit attributable to the parent company was 1.308 billion yuan to 1.408 billion yuan, a year-on-year increase of 754.11%-819.42%; The net profit after deduction is expected to be 1.318 billion yuan to 1.418 billion yuan, compared with a loss of 78.9613 million yuan in the same period last year. Under the circumstance that the company's revenue is expected to increase by about 30%, the net profit is expected to increase by more than seven times, and the non-net profit will be turned into a profit.

Weir said that in the first half of 2024, the market demand continued to recover, the demand of downstream customers increased, and with the company's product introduction in the high-end smartphone market and the continuous penetration of autonomous driving applications in the automotive market, the company's operating income has achieved significant growth; In addition, in order to better cope with the impact of industrial fluctuations, the company actively promoted the optimization of product structure and supply chain structure, the gross profit margin of the company's products gradually recovered, and the overall performance increased significantly.

From the market point of view, last year's popular Huawei P70 standard version is equipped with the OV50H main camera sensor of Haowei Technology, which has brought a positive demonstration effect to the promotion of 50 MP pixel CIS high-end positioning products in China's domestic brand mobile phones this year, and a number of domestic mobile phone manufacturers have adopted OmniVision Technology's 50 million pixel high-end CIS products since the second half of last year. While increasing the average unit price and profitability of Omnivision Technology's products, it also boosted the sales of other similar products.

The growth of domestic electric vehicle shipments has made OmniVision's on-board CIS products continue to sell well, and the continued popularity of the domestic brand medical device industry has also improved the business status of Omnivision Technology's medical CIS products.

From the market point of view, last year's fire Huawei P70 standard version is equipped with the OV50H main camera sensor of Haowei Technology, which has brought a positive demonstration effect to the promotion of 50MP pixel CIS high-end positioning products in China's domestic brand mobile phones this year, and a number of domestic mobile phone manufacturers have adopted OmniVision Technology's 50MP pixel high-end CIS products since the second half of last year. While increasing the average unit price and profitability of Omnivision Technology's products, it also boosted the sales of other similar products.

In the field of the most profitable 50MP mobile phone CIS chip, Weir has laid out a total of five products of OV50A/D/E/H/K40, and successfully stuck in the domestic high-end smart phone. Among them, OV50H/K40 focuses on the flagship main camera market, especially V50H has successfully won the share of domestic terminal flagship models such as Xiaomi, Huawei, Vivo, and Honor with its ultra-high-speed focusing ability and high dynamic range, and is applied to the wide and ultra-wide rear cameras of these high-end flagship smartphones; OV50K40 is the world's first CIS chip for smartphones to use TheiaCel technology, which achieves near-eye-level dynamic range in a single exposure with the LOFIC function. OV50A/E focuses on the mid-range model main camera market; With a pixel size of only 0.61 μm, the OV50D can be used for telephoto and other applications.

According to industry news, most of the models developed by Huawei this year have chosen Weir's CIS chips for the main cameras, of which the 50MP CIS chip is still the key procurement object. Under Huawei's demonstration, the shipment of 50MP CIS chips of Weir shares in the second half of the year is still worth the industry's expectations.

The industry said that in the first half of the year, with the recovery of the consumer electronics industry, the sales of smartphones also resumed growth, coupled with the continuous expansion of the demand for camera chips for electric vehicles, the CIS chip industry began to get out of the inventory clearance stage and entered the normal level of pulling goods. While the wafer factory is also releasing a large amount of domestic supply, the industry quotation has also begun to improve, and it is slowly getting out of the situation of inverted cost and selling price.

However, industry insiders also said that with the continuous release of domestic CIS chip production capacity, the price improvement of low-end mobile phone CIS chips and on-board CIS chips is not obvious, and it may usher in more fierce price competition in the second half of the year.