海能实业(SZ:300787)是3C配件巨头,当前年产值约为20亿,2023年海外营收占比达89.70%。在全球贸易环境变化后,海能实业从2022年起就筹划在越南新建厂房扩产,经过近两年的谨慎运作,终于砸下近6亿元的越南扩产项目即将开工建设。

近日海能实业公告,公司全资子公司海阳海能与越南TOKEN工程建设技术股份公司签订《建设工程施工合同》,合同金额为6487.67亿越南盾,约合2562万美元(人民币1.86亿)。该合同涉及越南新建年产3360万件消费类电子厂项目的一期和二期工程建设,预计一期工期为270天,二期工期为420天。

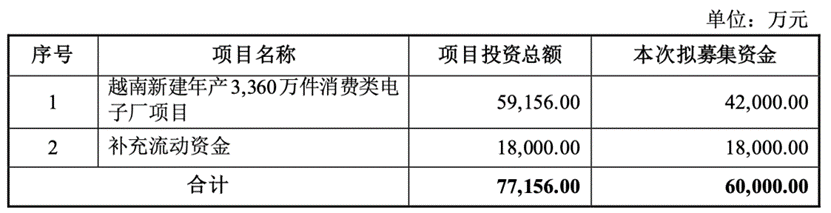

海能实业于2023年4月13日向不特定对象发行6,000,000张可转换公司债券,募集资金投资于“越南新建年产3,360万件消费类电子厂项目”及“补充流动资金”。

越南新建年产3360万件消费类电子厂项目用地位于越南海阳省,总投资5.92亿,拟实施主体为全资子公司越南海阳海能电子有限公司(以下简称“海阳海能”)。公司于2022年7月与安发1高科技工业区股份公司签署了关于海阳省南栅县安发1工业区CN5地块的原则合同,海阳海能已于2023年12月15日取得了该土地使用权证书。

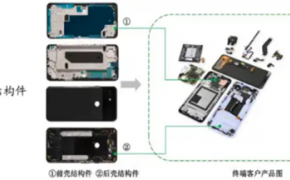

海能实业成立于2004年,专注于电子产品的研发和生产。公司产品包括电线电缆、信号适配器、转换器、拓展坞、充电器、电源插座、游戏电源、智能清洁产品、智能家居产品、能源储存系统以及便携式移动电源等,电子产品以ODM为主,为品牌客户提供从设计到生产的全过程服务,公司不直接从事网络平台的C端销售。

2018年12月6日海能实业通过香港海能100%持股设立了越南海能电子有限公司,总部位于越南北江省安勇县内黄乡双溪内黄工业区FJ-25号,云中II工业区CNSG04和CNSG06号,主要从事生产制造电源产品、耳机、信号连接产品、信号线缆等消费电子产品的业务。

海能实业表示,已与Belkin、亚马逊等国际知名品牌商建立长期稳定的合作关系,越南扩产后能够进一步加快全球化布局,并利用越南的区位、人力、营商税收等优势提升公司的盈利能力。此外,公司在越南建设生产基地,将产品直接出口至境外市场,可进一步完善国际化布局,减少国际贸易形势变化对公司成本的影响,从而提升公司的抗风险能力,促进公司长远发展。

2018年以来,国际经济贸易不稳定因素仍在持续。在经贸领域,美方对中国出口的产品加征关税,以保护美国国内制造业的优势。随着加征关税产品种类规模不断扩大、税率不断提高,越来越多的中国国内制造业受到影响。海能实业的产品以外销为主,主要销往北美洲、欧洲、亚洲各国家和地区。其中,美国由于经济发展水平高、消费能力强,是海能实业出口的重要市场之一。然而,自2018年9月起,海能实业的主要产品出口被列入美国实施加征关税清单,加征10%关税,到2019年5月,海能实业的相关产品对美国出口关税税率提升至25%。关税的上升,将削弱海能实业从中国出口至美国产品的竞争优势,对海能实业的盈利能力及存货周转能力产生不利影响。

因此,海能实业通过在越南建设生产基地,扩大越南工厂的产能,并将越南工厂生产的产品出口至美国,以规避关税对利润的影响。海能实业认为项目的实施,将有助于海能实业克服贸易保护主义、单边主义带来的成本、存货周转等风险,维护公司平稳运营,增强公司可持续发展能力。

越南正常化后,迅速通过各种互惠关贸协议融入全球经济,吸引了美、日、韩、台企业大量进驻投资,形成了较强的制造业基础。随着富士康,立讯精密,海能实业等需要大量普通工人的制造业巨头转战越南,全球制造业的转移浪潮越发汹涌。而去年AI人工智能主权大战开启后,台资企业大量增资越南与泰国,引领东南亚投资领域一片繁荣。

另一方面,随着经济全球化趋势不断深入,中国大陆为积极推动国内经济发展,鼓励部分企业“走出去”,参与国际化市场竞争,以提升企业的行业地位。而以越南为代表的东盟国家,由于与中国大陆之间有着较为紧密的经贸关系,加上地理位置上的便利性,成为了众多中资企业出海的第一站。

Haineng Industrial (SZ: 300787) is a 3C accessories giant, with a current annual output value of about 2 billion yuan, and overseas revenue will account for 89.70% in 2023. After the change of the global trade environment, Haineng Industry has been planning to build a new plant in Viet Nam to expand production since 2022, and after nearly two years of careful operation, the Viet Nam expansion project of nearly 600 million yuan is about to start construction.

Recently, Haineng Industrial announced that Haiyang Haineng signed the "Construction Project Construction Contract" with Viet Nam TOKEN Engineering Construction Technology Joint Stock Company, with a contract amount of 648.767 billion Viet Nam dong, equivalent to about 25.62 million US dollars (186 million yuan). The contract involves the construction of the first and second phases of Viet Nam's new 33.6 million pieces per year consumer electronics factory project, which is expected to last 270 days in the first phase and 420 days in the second phase.

On April 13, 2023, Haineng Industrial issued 6,000,000 convertible corporate bonds to unspecified targets to raise funds to invest in "Viet Nam's new consumer electronics factory project with an annual output of 33.6 million pieces" and "replenishment of working capital".

Viet Nam's new consumer electronics factory with an annual output of 33.6 million pieces is located in Hai Duong Province, Viet Nam, with a total investment of 592 million yuan, and the proposed implementation entity is Viet Nam Haiyang Haineng Electronics Co., Ltd. (hereinafter referred to as "Haiyang Haineng"), a wholly-owned subsidiary. In July 2022, the Company signed a contract in principle with An Phat 1 Hi-Tech Industrial Park Joint Stock Company for the CN5 plot in An Phat 1 Industrial Zone, Nam Zha District, Hai Duong Province, and Hai Duong Hai Neng has obtained the land use right certificate on December 15, 2023.

Founded in 2004, Haineng focuses on the R&D and production of electronic products. The company's products include wires and cables, signal adapters, converters, docking stations, chargers, power sockets, game power supplies, smart cleaning products, smart home products, energy storage systems and portable mobile power supplies, etc., electronic products are mainly ODM, providing brand customers with the whole process of service from design to production, the company is not directly engaged in the C-end sales of the network platform.

On December 6, 2018, Haineng Industrial established Viet Nam Haineng Electronics Co., Ltd. through 100% shareholding of Hong Kong Haineng Electronics, headquartered at No. FJ-25, Sungai Nei Hoang Industrial Zone, Nai Hoang Township, An Yong County, Bac Giang Province, Viet Nam, CNSG04 and CNSG06, Yunzhong II Industrial Zone, mainly engaged in the production and manufacture of consumer electronic products such as power products, earphones, signal connection products, signal cables, etc.

Haineng Industry said that it has established long-term and stable cooperative relations with international well-known brands such as Belkin, http:// StarTech.com, Amazon, etc., and Viet Nam can further accelerate the global layout after the expansion, and use the advantages of Viet Nam's location, manpower, business and taxation to improve the company's profitability. In addition, the company has built a production base in Viet Nam to directly export its products to overseas markets, which can further improve the international layout and reduce the impact of changes in the international trade situation on the company's costs, thereby enhancing the company's anti-risk ability and promoting the company's long-term development.

Since 2018, international economic and trade instability has continued. In the economic and trade field, the United States has imposed tariffs on Chinese exports to protect the advantages of United States' domestic manufacturing industry. With the continuous expansion of the scale of the types of products subject to tariffs and the continuous increase of tax rates, more and more of China's domestic manufacturing industry has been affected. Haineng Industrial's products are mainly exported to North America, Europe, and Asian countries and regions. Among them, United States is one of the important markets for Haineng Industry due to its high level of economic development and strong consumption capacity. However, since September 2018, Haineng Industrial's main product exports have been included in the list of additional tariffs imposed by the United States, with an additional 10% tariff, and by May 2019, the export tariff rate of Haineng Industrial's related products to the United States has been increased to 25%. The increase in tariffs will weaken the competitive advantage of Haineng Industrial's exports from China to United States, and adversely affect Haineng Industrial's profitability and inventory turnover.

Therefore, Haineng Industrial has expanded the production capacity of its Viet Nam factory by building a production base in Viet Nam and exported the products produced in the Viet Nam factory to United States to avoid the impact of tariffs on profits. Haineng believes that the implementation of the project will help Haineng to overcome the risks of cost and inventory turnover caused by trade protectionism and unilateralism, maintain the company's smooth operation, and enhance the company's sustainable development ability.

After the normalization of Viet Nam, it quickly integrated into the global economy through various reciprocal tariff and trade agreements, attracting a large number of enterprises from the United States, Japan, South Korea and Taiwan to invest in the country, forming a strong manufacturing base. With manufacturing giants such as Foxconn, Luxshare Precision, and Haineng Industry that need a large number of ordinary workers moving to Viet Nam, the wave of global manufacturing transfer is becoming more and more turbulent. After the AI sovereignty war started last year, Taiwan-funded enterprises increased their capital in Viet Nam and Thailand, leading the prosperity of Southeast Asia's investment field.

On the other hand, with the deepening trend of economic globalization, in order to actively promote domestic economic development, Chinese mainland encourages some enterprises to "go global" and participate in international market competition, so as to enhance the industry status of enterprises. ASEAN countries represented by Viet Nam, due to their close economic and trade relations with Chinese mainland and the convenience of geographical location, have become the first stop for many Chinese-funded enterprises to go overseas.