近日媒体报道称纬创将在越南北部河南省投资2,450万美元建新厂。越南媒体《The Investor》引述越南环境资源部公告的文件指出,这项名为「Victory II」的建厂计划,将在同文三期工业园区(Dong Van III)启动,占地4.9公顷(约14,822坪),由纬创越南子公司推动该投资。

纬创6月25日表示,该投资案为去年8月董事会通过新设立的越南子公司,隶属越南一期厂区,主要生产显示器、AIoT产品。项目为董事会去年8月通过因应业务发展及策略规划需要,拟以2,450万美元,投资新设越南子公司Wistron Technology(Vietnam)Co., Ltd.,此次投资项目即为去年董事会通过的议案。

纬创在2020年4月赴越南布局产能基地,并启动该基地一期工厂建设,2021年12月开始营运,越南厂区主要产能为显示器、笔电、桌机与服务器等产品线。去年6月纬创越南开始兴建二期,计划今年下半年完工,预计第4季或明年初投入营运。纬创在越南总投资额已达3.639亿美元。

纬创二期的目标为10月完成行政程序,11月安装机械与设备,接着正式投产。这座工厂年产能将为300万片液晶显示器面板、19.8万个防火墙装置(相当于198吨)、103万台扩充基座(相当于541吨)以及3.5万台网路摄影机(相当于241吨)。

纬创表示,今年资本支出预计约140亿美元,主要投资集中中国台湾、越南及墨西哥等地扩厂需求,持续提升非大陆产能,仅约15%用于大陆既有产能扩充支出,美国加州也有新产能在试产。

作为全球顶级的ODM专业供应商,纬创(Wistron)成立于2001年,其前身为宏碁电脑1981年成立的DMS部门(设计、生产和服务部门)。

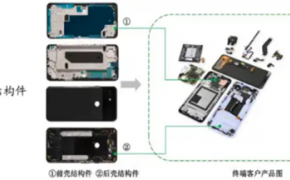

纬创一直专注于笔记型电脑、台式机的ODM设计、制造与服务。在2003年实现在中国台湾证券交易所上市(证券代码为3231.TW)。此后,在智能手机/移动互联网时代,公司将业务由电脑向手机、服务器、医疗等领域拓展。在2022年,纬创在世界500强排行榜中公司排名第462位,一举跃升为全球第七大ODM厂商。

目前纬创的客户主要以戴尔、惠普、微软、亚马逊、meta、英伟达、AMD等为代表的美系科技公司为主,销售额约占公司总收入的一半左右。此外,欧洲客户的销售占比约为22%,而中国市场联想、浪潮等客户合计占比约为12%左右。

根据MIC数据,2022年中国台湾代工的笔记本电脑约1.36亿台,台式电脑约为4161万台,服务器约1132万台,占全球出货量的比例分别为72.6%、45.3%、80.6%。其中纬创的笔记本、台式电脑及服务器产量分别约占15%、21%及33%,数量分别为2038万台、874万台、373万台。从上述数据可以看到,纬创目前在笔记本、台式电脑及服务器三大领域拥有非常强的市场竞争力。

此前纬创显示屏业务扩产动作,还是发生在2021年7月收购JDI旗下的子公司晶杰达。当时纬创集团子公司鼎创斥资80亿日元(约人民币4.68亿元)买下了日本中小尺寸面板厂JDI旗下台湾子公司高雄晶杰达,一举将公司的液晶显示模块(LCM)事业扩展到车载、工控领域市场,进而提升了营运效益。

同时为了提升AI服务器领域的竞争力,在2023年6月,纬创斥资9.99亿元新台币(当前约2.33亿元人民币),以每股1448元新台币(当前约337元人民币)的价格,入股芯片设计服务厂世芯。纬创认为,随着生成式AI热潮带动服务器需求量不断攀升,公司业务与世芯形成互补,未来将带动公司业务不断向高附加价值产业进行结构升级。

在手机业务上,纬创一直以来都是苹果iPhone的主要供应商之一,不过由于为iPhone代工利润率不高,纬创近年来计划逐步退出iPhone组装链条。2020年7月,纬创就将位于中国大陆盈利能力较弱的纬新资通(昆山)有限公司、纬创投资(江苏)有限公司及其相关业务以人民币33亿元的价格转让给了立讯精密;2023年10月,纬创再次将公司位于印度的苹果代工厂以1.25亿美元的价格出售给了塔塔集团,彻底结束了苹果的低端代工业务。

而在东南亚市场上,目前纬创已经在马来西亚、菲律宾、印度、越南等多个国家有业务布局。据旭日大数据李星了解,目前纬创是英伟达和AMD的AI服务器供应商,纬创继续投资越南,除了加强笔电、网通等业务外,与富士康一样,配合英伟达和AMD增加越南AI服务器的产能,也是纬创的未来重点布局方向。

目前越南政府一直在寻求美国和韩国的帮助,提供技术转移与人员培训,希望能够把AI服务器的产能最大限度的抓在手上。越南政府已经对英伟达、台积电和三星发出邀请,希望这些厂商能从AI芯片代工的服务环节开始,让越南除了承接AI服务器的线缆、主板、光纤与服务器组装、AI交换机的组装等代工业务外,还可以介入到AI服务器的周边配套芯片设计与封装测试环节,并最终实现在越南建立晶圆厂的目的。

Recently, media reported that Wistron will invest US$24.5 million to build a new factory in Henan province in northern Vietnam. Vietnamese media "The Investor" quoted a document announced by the Ministry of Environment and Resources of Vietnam as pointing out that the construction plan called "Victory II" will be launched in Dong Van III Industrial Park, covering an area of 4.9 hectares (about 14,822 pings), and the investment will be promoted by Wistron Vietnam's subsidiary Vietnam.

Wistron said on June 25 that the investment project is a newly established subsidiary in Vietnam approved by the board of directors in August last year, which belongs to the first phase of the Vietnam factory and mainly produces displays and AIoT products. The project was approved by the board of directors in August last year to invest US$24.5 million in Wistron Technology (Vietnam) Co., Ltd., a new subsidiary in Vietnam, in response to business development and strategic planning needs. In April 2020, Wistron went to Vietnam to lay out a production capacity base, and started the construction of the first phase of the base, which started operation in December 2021, and the main production capacity of the Vietnam factory is displays, laptops, desktops and servers. Construction of the second phase of Wistron Vietnam began in June last year, which is scheduled to be completed in the second half of this year and is expected to be operational in the fourth quarter or early next year. Wistron's total investment in Vietnam has reached US$363.9 million.

The goal of Wistron Phase 2 is to complete the administrative process in October, install the machinery and equipment in November, and then officially start production. The plant will have an annual production capacity of 3 million LCD panels, 198,000 firewall units (equivalent to 198 tons), 1.03 million docking stations (equivalent to 541 tons) and 35,000 IP cameras (equivalent to 241 tons).

Wistron said that this year's capital expenditure is expected to be about US$14 billion, mainly focused on the expansion of factories in Taiwan, Vietnam and Mexico, and continued to increase non-mainland production capacity, only about 15% of which is used for the expansion of existing production capacity in the mainland, and new production capacity is also in trial production in California, the United States.

As the world's top ODM professional supplier, Wistron was founded in 2001, and its predecessor was the DMS division (design, production and service department) established by Acer Computer in 1981.

Wistron has been focusing on ODM design, manufacturing and service of notebooks and desktops. In 2003, it was listed on the Taiwan Stock Exchange of China (stock code: 3231.HK). TW)。 Since then, in the era of smart phones/mobile Internet, the company has expanded its business from computers to mobile phones, servers, medical and other fields. In 2022, Wistron ranked 462nd in the Fortune Global 500 list, making it the world's seventh largest ODM vendor.

At present, Wistron's customers are mainly American technology companies represented by Dell, HP, Microsoft, Amazon, meta, NVIDIA, AMD, etc., and sales account for about half of the company's total revenue. In addition, European customers accounted for about 22% of sales, while customers such as Lenovo and Inspur in the Chinese market accounted for about 12% of the total.

According to MIC data, in 2022, there will be about 136 million laptops, 41.61 million desktop computers, and 11.32 million servers in Taiwan, China, accounting for 72.6%, 45.3%, and 80.6% of global shipments, respectively. Among them, Wistron's notebook, desktop computer and server production accounted for about 15%, 21% and 33% respectively, with the number of 20.38 million units, 8.74 million units and 3.73 million units, respectively. From the above data, it can be seen that Wistron currently has very strong market competitiveness in the three major fields of notebooks, desktop computers and servers.

The previous expansion of Wistron's display business occurred in July 2021 with the acquisition of Jingjieda, a subsidiary of JDI. At that time, Dingchuang Group, a subsidiary of Wistron Group, spent 8 billion yen (about 468 million yuan) to buy Kaohsiung Jingjieda, a Taiwanese subsidiary of JDI, a Japanese small and medium-sized panel manufacturer, and expanded the company's liquid crystal display module (LCM) business to the automotive and industrial control markets in one fell swoop, thereby improving operational efficiency.

At the same time, in order to enhance its competitiveness in the field of AI servers, in June 2023, Wistron invested NT$999 million (currently about RMB 233 million) at a price of NT$1,448 per share (currently about RMB 337) to take a stake in the chip design service company Worldchip. Wistron believes that with the rising demand for servers driven by the generative AI boom, the company's business complements that of Worldchip, which will drive the company's business to continuously upgrade to high value-added industries in the future.

In the mobile phone business, Wistron has always been one of Apple's main suppliers of iPhones, but due to the low profit margin of iPhone OEM, Wistron has planned to gradually withdraw from the iPhone assembly chain in recent years. In July 2020, Wistron transferred Wistron (Kunshan) Co., Ltd., Wistron Investment (Jiangsu) Co., Ltd., and their related businesses located in Chinese mainland with weak profitability to Luxshare Precision for RMB3.3 billion. In October 2023, Wistron once again sold the company's Apple foundry in India to Tata Group for $125 million, completely ending Apple's low-end foundry business.

In the Southeast Asian market, Wistron has business in Malaysia, the Philippines, India, Vietnam and other countries. According to Li Xing of Rising Sun Big Data, Wistron is currently the AI server supplier of NVIDIA and AMD, and Wistron continues to invest in Vietnam, in addition to strengthening laptops, Netcom and other businesses, and like Foxconn, it is also the key direction of Wistron's future layout to cooperate with NVIDIA and AMD to increase the production capacity of AI servers in Vietnam.